The Cape’s ‘population problem’ isn’t a problem

Published in Banker & Tradesman, November 27, 2017

EXPANDED DATA PAINTS A PICTURE OF A THRIVING CAPE

By Mahesh Ramachandran

It’s an oft-told tale: Young people are fleeing Cape Cod, resulting in a declining population for the foreseeable future and signaling a contraction of our workforce.

But what if that’s not the case? We dove into the numbers, counting methods and economic data and reached conclusions that challenge, if not dispel, the accepted and widely repeated assumptions about Cape Cod’s population.

The Cape’s demographics are changing and the year-round population is getting older, but the best explanation isn’t found in the exodus story. It’s related to how the Cape’s popularity as a second-home destination skews the real estate market and availability of housing. The misunderstanding is reasonable. A straight look at numbers from the 2000 and 2010 Census shows 15,000 fewer residents between the ages of 25 and 44, more deaths than births, and an increase in residents age 60 and older. The story certainly sounds right, and aligns with expectations about the Cape’s wage level and cost of living.

But what’s happening is more dynamic. The Census is an inventory of population and ages at regular intervals, but does not account for aging. Those 25- to 44-year-olds in 2000 were 35 to 54 years old 10 years later. When tracked by age, each five-year age group of Cape residents between 30 and 70 increased slightly between 2000 and 2010. About a third of the increase came from those between the ages of 30 and 44 years old. There was net positive migration as well during this period. The younger residents didn’t leave – they simply got older.

The outpacing of births by death is not uncommon in communities that attract retirees. It’s a part of the population that resupplies itself from outside the county, making comparisons of birth and death rates less reliable predictors of population trends.

Macroeconomic indicators show a healthy economy on Cape Cod with no signs that would support a labor force loss that an out-migration of working-age residents would represent. For example, the growth rate in year-round employment between 1990 and 2014 is 33 percent, higher than Massachusetts and the U.S., and growth in the regional economy was 3 percent between 2000 and 2010, despite the recession.

Affordable Housing Issues

While the overall economy on the Cape is doing well, in general the Cape remains an unappealing place for both young people and older adults looking to downsize. Growth in working-age population shows a slowing trend relative to previous decades. So what’s deterring in-migration of working-age residents? Availability of workforce housing with desirable amenities, including affordability and proximity to job centers and schools are key factors in that discussion. Currently, single-family homes with a median value of $362,800 comprise 85 percent of the housing stock, well beyond the reach of workforce wages.

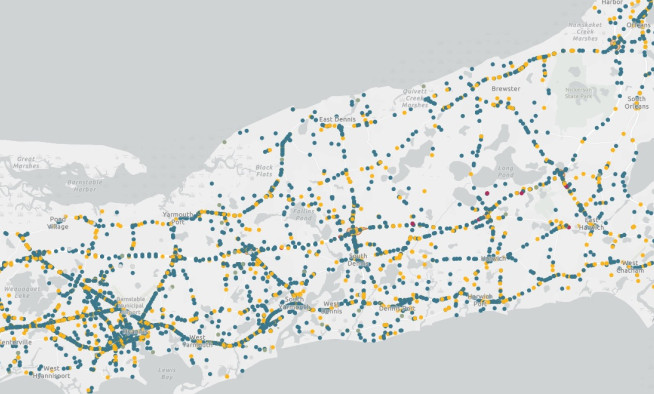

A review of housing units on the Cape emphasizes the point. Barnstable County ranks seventh in the nation in sheer number of seasonal units, fifth in proportion to land area and has half of all seasonal homes in Massachusetts. While seasonal homes constitute only 4 percent of the housing stock in the state, they are 37 percent of the Cape’s housing stock.

This can be seen in the construction of new units as well. In rough numbers, Cape Cod added 13,000 new housing units from 2000 to 2010, of which 9,000 were classified as seasonally vacant. Based on available data, in the five years since the 2010 Census, Barnstable County shows a loss of 3,800 year-round units and a gain of 5,000 seasonal homes. Homes available for sale are falling, from 4,779 in 2011 to 2,952 in 2015 – a 38 percent drop. A lower supply of suitable housing stock for the year-round workforce creates a self-reinforcing negative effect on the economy. A restricted supply of homes for the workforce restricts labor supply, dampens growth in the year-round economy and supports dire projections for the demographic composition, which in turn affects the investment in workforce housing and infrastructure. The other demographic affected by the lack of diversity in the housing supply is the current year-round retiree looking to move on to the next life stage and downsize.

What we need is an increase in both the number and diversity of housing types and sizes. The standard method to project population trends paints a poor, declining future for Cape Cod. That’s not what we see based on an expanded set of factors. The overall population number may or may not rise, but it’s unlikely to drop by the numbers suggested. That said, the lack of housing for younger families, the conversion of year-round homes to seasonal use, and the reduced supply of new homes remain cause for concern. Understanding the relationship between the changing demographics and the housing market is important for the region.

An immediate concern is the effect inaccurate population projections have on state and federal funding formulas. Focusing on the underlying reasons for these discrepancies will help in drafting the right policies to keep the Cape’s economy healthy.

Mahesh Ramachandran, Ph.D., is an environmental economist with the Cape Cod Commission. He may be reached at mramachandran@capecodcommission.org.

Related Posts